Crypto Sundays is a free Sunday newsletter. If you love it, consider sharing it or leaving a comment below. New to Crypto Sundays? Start here.

Over the past few weeks, I've been having an absurdly high number of conversations about NFTs.

And how could I not? NFTs, and more broadly, the ~metaverse~, have been breaking the news consistently...

Just a few days ago, ~$600m in ETH was stolen from the NFT gaming blockchain Ronin Network.

A few days before that, the virtual world Decentraland hosted a "Metaverse Fashion Week", featuring big names like Estée Lauder and Dolce & Gabbana:

And just a bit before that, the owner of "blue chip" NFT collections like Bored Apes and CryptoPunks raised $450m to build their own Metaverse empire:

That's a BIG deal. Not so long ago, the word "NFT" was a fancy terminology that you could brush off as a cultural bubble. That doesn't seem to be the case anymore.

And yet, to my dismay, many of the conversations I had ended up in me cryptosplaining what NFTs even were. Repeatedly, people would dismiss NFTs as "speculative JPEGs" and only see the underlying value once they understood the technology underneath.

So here it is: my understanding of these speculative JPEGs, explained to you in 5 of my own JPEGs.

1/ 💎 Make it non-replaceable

We're hardwired to prize what is scarce. That's why gold and diamonds are deemed more valuable than water or sand. Scarcity is the bedrock upon which our monetary systems succeed. It's also the bedrock on which protocols like Bitcoin succeed.

But even though Bitcoin has a fixed cap of 21 million coins that can go into circulation, each coin is the same as another. Coins aren't "unique".

If I pay you 1 BTC and someone else pays you 2 BTC, you could add them up and claim that you own 3 BTC, because you're receiving "tokens" that are homogenous in value.

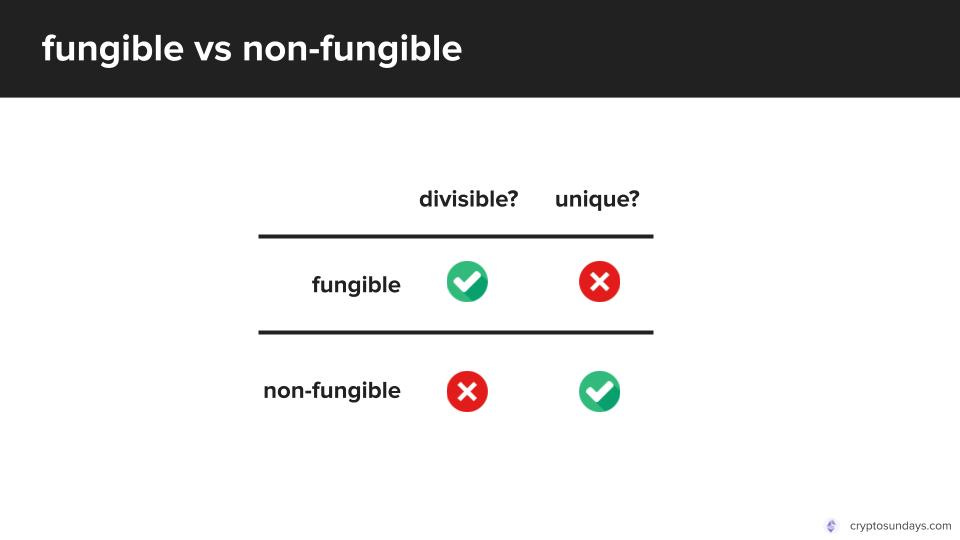

These coins are also divisible – instead of paying you 1 BTC, I could pay you in two transactions of 0.5 BTC each with no harm done. Combine the uniqueness with the divisibility, and we have what you call a replaceable or "fungible" token.

NFTs hold the opposite properties. They're atomic in nature: they cannot be divided into smaller parts. They're also encoded to be unique: the supply of the token is set to be 1. Non-divisible + unique = "non-fungible". It's that simple.

2/ 💭 Let's play a game: "fungible or non-fungible"

I'll let you ponder over each of these for a bit so you start to grasp what makes something "non-fungible".

. . .

Limited edition cards are tricky. They could be one-of-a-kind or part of a collection of, say, a hundred cards, which would make them semi-fungible.

Dollar bills fit into the same bucket. Each dollar bill is interchangeable with another and they're all divisible into cents. But, every dollar bill has a unique serial number printed at the bottom. So, is it non-fungible? It depends on your perspective.

Let's go back to NFTs. An NFT stands for a "Non-Fungible Token". Here's a simple definition you can bookmark in your mind --

Non-fungible tokens are scarce digital assets "stored" on a blockchain.

They could represent anything. A drawing, a song, the PDF of a book you wrote, etc. In a sense, these are all digital assets.

But where exactly are these NFTs? Every now and then someone comes up and asks ,"Why should I pay millions of dollars for a JPEG of an ape if I could just download it?". To answer that, let's talk about storage.

3/ 📦 Blockchains are bad storage units

Blockchains are essentially a storage system for transactions. They allow a secure, decentralized way to record the shuffling of value from one address to another.

In the last post, I explained that it's costly to "write" to a blockchain. Computers maintaining the blockchain need to store an entire copy of it, which contains countless transactions made by people across the world.

Clearly, it doesn't make sense to store other people's JPEGs and MP4s on the blockchain, because those are too large in file size. That's why the underlying NFT asset isn't stored on-chain. In reality, here's what happens:

You upload the asset on a storage system better suited for large files. This could be on a server (like Amazon's AWS) or a peer-to-peer network like IPFS.

You'll now have a URI or link pointing to your file. Include this link along with your NFT's name, description, and other attributes in a "metadata file", which you also upload on a storage system.

On the blockchain, you store a link to this metadata file as part of a token with a supply of 1. That's your non-fungible token.

Wallets automatically "fetch" and "transcribe" the metadata file to show you your NFT asset, along with its name, description, etc. That's how you go from the structured information to the blue elf in the picture above.

4/ 👓 An NFT is what you make of it

So, even though we normally think we own the cool JPEG, what we're actually owning is a pretty-looking file that points to where the JPEG is stored.

Of course, that opens a big question: is the image the NFT, or is the NFT just a blockchain token which is represented by an image? That's up to the eye of the beholder.

As a Computer Scientist, you might think of the NFT as a regular token sugarcoated with a nice image, almost like an expensive wrapping paper.

As an art collector, you might think of tokens as the technology that make digital art collection possible. With that mindset, NFTs are valued purely on artistic qualities.

5/ 🐵 NFTs > > > expensive monkey JPEGs

When I say an NFT is what you make of it, I truly mean it. People's opinions on NFTs lie on a spectrum, ranging from "they're useless, speculative assets" to "they're going to change the future of ownership".

Personally, I think the NFT market is etching towards "utility NFTs", where owning the NFT gives or represents some kind of utility in the metaverse or real life. That opens up a different view of what NFTs really represent: certificates.

They could be certificates of entry to an event. Or, they could be certificates of owning virtual or real land. The possibilities of an NFT representing a certificate are truly limitless.

But they're more than just certificates, because underlying each token is an automatic capability to buy and sell it. So what you're really getting is a certificate with a de facto way of creating a market around it. That's VERY powerful.

And that's the closing thought I want to leave you all with today. We really just are at Day 1.

Special thanks to Jorge Zreik, Ron Miasnik, and Joseph Rubin for designing the content that my post is structured around. I couldn't have written this post without them.